Reports and articles

Rising above challenges: the resilience and innovation of UK aerospace manufacturing

Published on February 21st 2024

The UK’s aerospace manufacturing industry faced tough times between 2006 and 2015, with a recent setback due to job losses and restructuring during the COVID-19 pandemic. But despite these challenges, the UK remains a major global player in aerospace, boasting a high trade surplus and investing heavily in innovation and research.

How has it managed to navigate the economic and geopolitical challenges of the past decade, and what measures are being taken to ensure the sector remains resilient on the global stage?

For the 2023 Innovation Report, we consulted sectoral experts and reviewed the literature to understand the factors contributing to the sector’s value-added, productivity, and trade trends. Talking to companies provided us with a better understanding of what the figures really mean for the industry, and we uncovered key drivers that help explain these sector trends.

The UK aerospace sector – what the data tells us

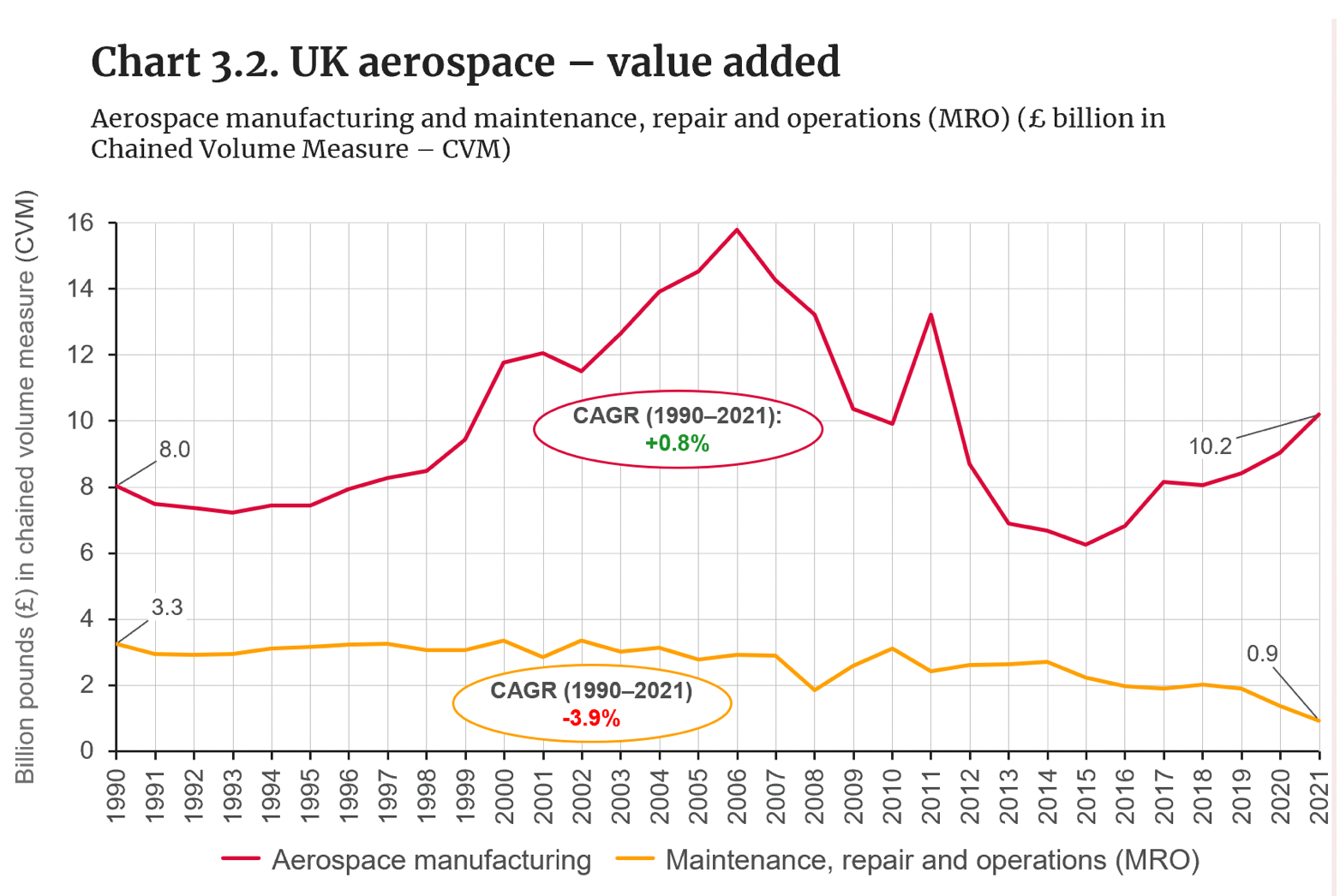

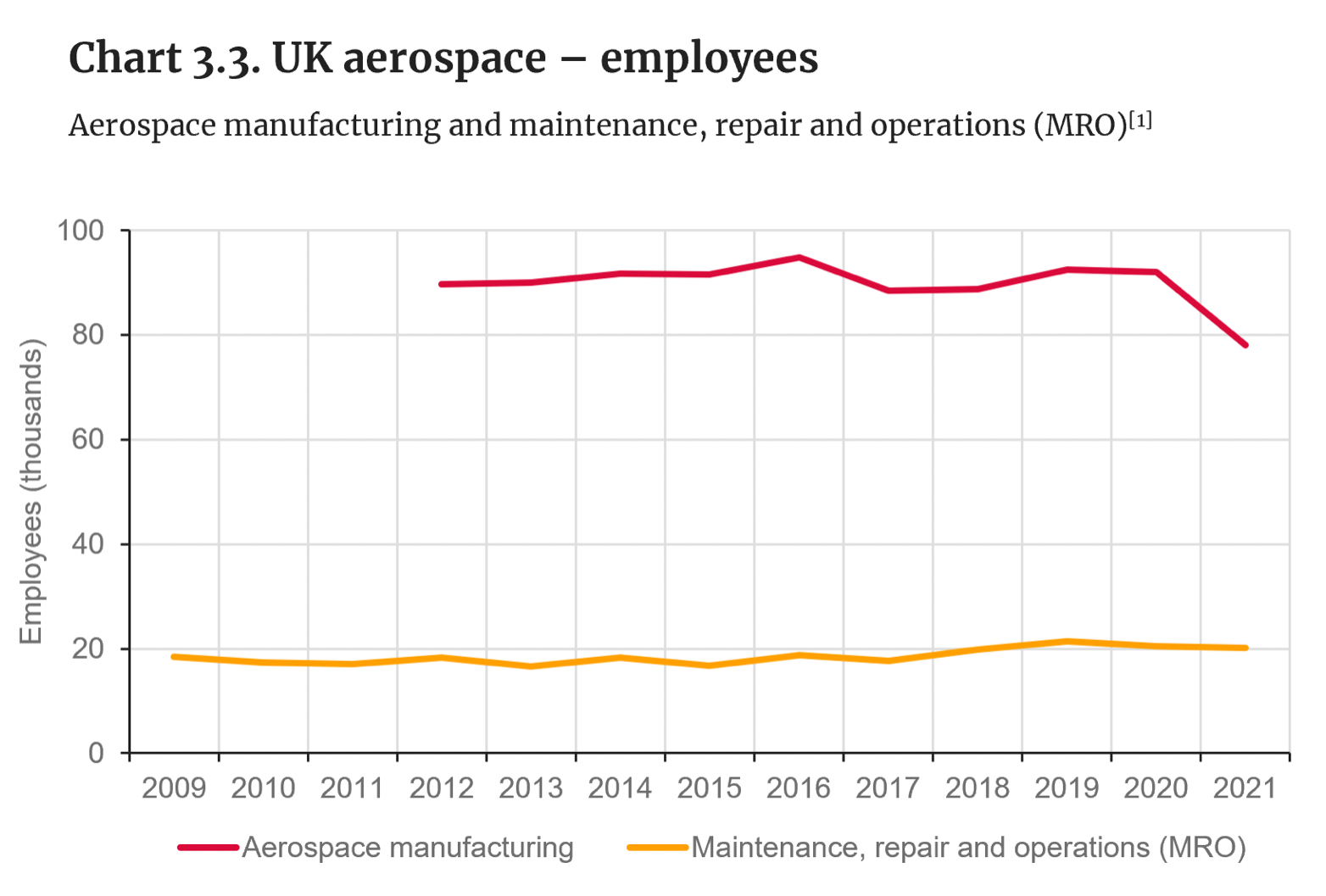

Data presented in the 2023 Innovation Report reveals that the UK’s aerospace manufacturing sector experienced a decline in value added from 2006 to 2015. Despite subsequent recovery and growth until 2021, the industry experienced a setback with a loss of 14,000 jobs in 2020-21, attributed to company restructuring associated with lower production levels during the COVID-19 pandemic.

Value added for maintenance, repair and operations (MRO) remained stable between 1990 and 2010 despite a short-term decrease during the 2008 financial crisis. MRO value added decreased by around two-thirds after 2010, reaching £0.9 billion in 2021, compared to £3.3 billion in 1990.

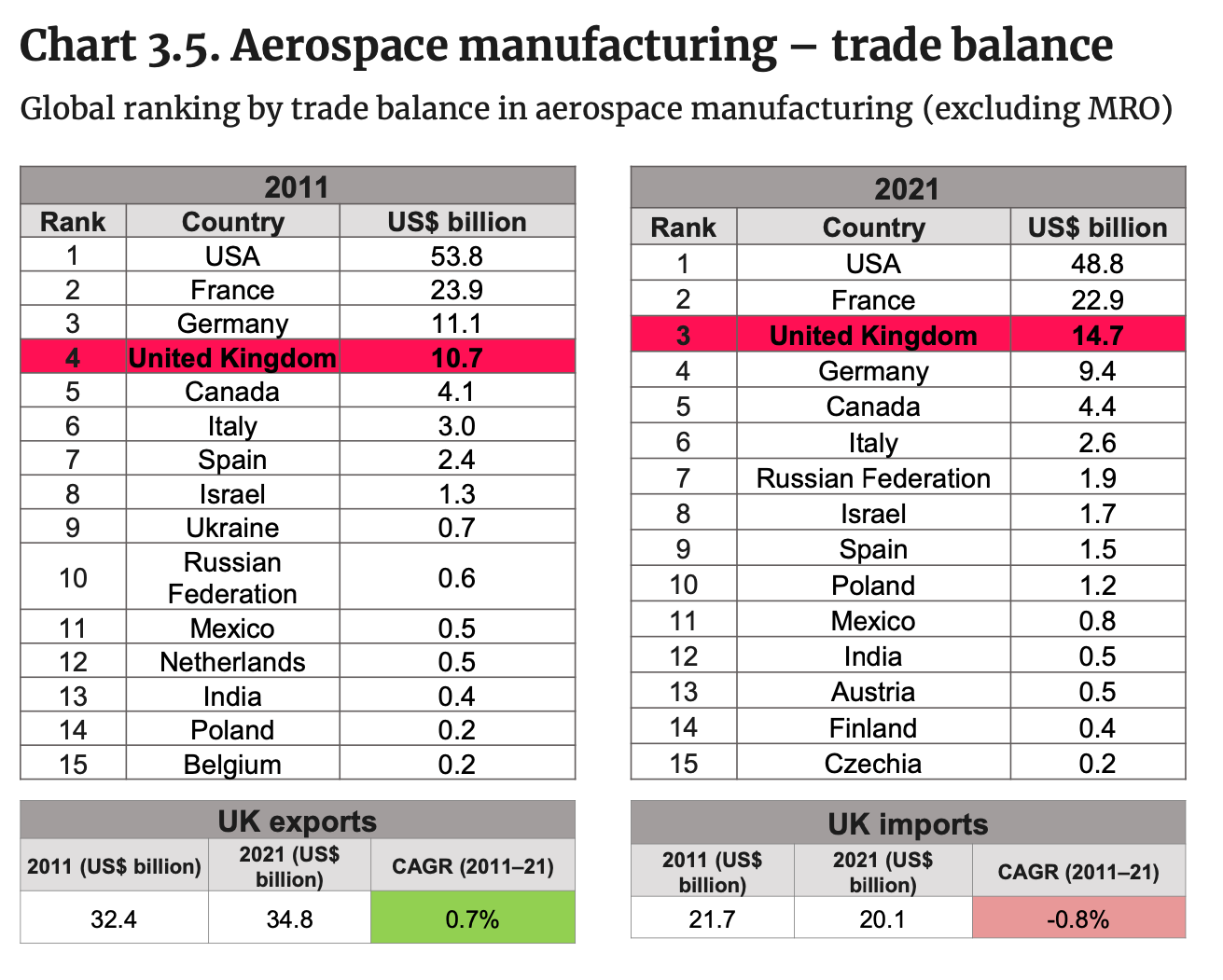

Nevertheless, the UK remains a significant player in the global aerospace industry and maintains a high trade surplus, which confirms its competitiveness and economic importance on the international stage. The UK has one of the highest aerospace trade surpluses among comparator countries and was the third largest net exporter of aerospace products in 2021, with a surplus of US$14.7 billion.

The sector also demonstrated a commitment to innovation through steady growth in business R&D expenditure from 2010 to 2019, spending 37% more in 2019 than in 2010. Furthermore, between 2012 and 2021, labour productivity in UK aerospace manufacturing increased.

After consulting with stakeholders, several key themes emerged as driving these sector trends:

The aerospace market is typically cyclical and sensitive to global crises

The aerospace market is typically cyclical and sensitive to global crises, with the cycles closely linked to global economic performance. External events such as the 9/11 terrorist attacks, the SARS crisis, and conflicts in the Middle East have historically disrupted the demand for air travel, subsequently affecting aircraft demand. Notably, the 2008 financial crisis had a lower impact on the UK aerospace sector, which can be attributed to government support and robust order books from major manufacturers. Data from civil aircraft manufacturers shows that both Boeing and Airbus had fewer aircraft deliveries during the COVID-19 pandemic, although this trend started to recover in 2021. In the case of Boeing, aircraft deliveries fell substantially in 2018 and 2019 following the suspension of deliveries of the 737MAX as the result of a series of safety concerns.

Foreign-owned OEMs’ shaping UK aerospace supply chains

The UK aerospace supply chain is heavily impacted by the demand from a select group of predominantly foreign-owned Original Equipment Manufacturers (OEMs). The sector is characterised by clusters of companies specialising in producing intricate aircraft components for OEMs, both within the UK and internationally. The decision-making process for investments in the UK aerospace sector, often influenced by the foreign ownership of manufacturing firms, predominantly occurs in headquarters abroad, particularly in France, Germany, or the United States.

Company restructuring and supply chain consolidation

The recent decline in aerospace manufacturing employees is predominantly attributed to the effects of the COVID-19 pandemic, leading to significant company restructuring and supply chain consolidation. Key industry players like Rolls-Royce and Airbus underwent restructuring efforts in response to reduced production levels during the pandemic, eliminating 8,500 and 1,700 jobs, respectively. Stakeholders noted that OEMs are increasingly outsourcing the development of entire sub-systems instead of individual components to enhance production efficiency and cost-effectiveness. This trend has led top-tier suppliers to consolidate the aerospace industry by providing comprehensive manufacturing services from system to component levels. Such strategic shifts have contributed to a streamlined supply chain, reducing the reliance on numerous suppliers for completing new aircraft designs.

Specialisation in engines and aircraft components continues to drive UK aerospace exports

According to Make UK (2019), aerospace is highly export-intensive, with 59% of production exported by value, making it the highest of any manufacturing sector. The UK specialises in engines and aircraft parts, which is reflected in its exports, accounting for 79% of all UK aerospace overseas sales in 2016. Among these exports, 35% of the parts were wings, fuselage, doors, control surfaces, landing gear, and fuel tanks, while 23% were turbojet engines and 20% were engine parts. In contrast, 47% of the total supply into production was imported in 2014, highlighting the need for seamless trade in the sector.

Long-term order and contract pipelines shape investment planning and add resilience

Long-term order and contract pipelines shape investment planning and add resilience to the sector. New aircraft orders commit original equipment manufacturers (OEMs) and their key suppliers to long-term contracts, providing companies across the supply chain with the certainty to invest and innovate in the long term [Make UK, 2019].

What is driving business R&D expenditure trends in aerospace manufacturing?

The data revealed that the UK aerospace industry is a high-value sector driven by innovation. The industry’s innovation ability has ensured its international competitiveness by keeping it at the forefront of technological development.

This is partly due to the UK government playing a crucial role in fostering research and development, innovation, and competitiveness in the aerospace sector. Several key initiatives, including the UK Aerospace Research and Technology Programme (ATI), the Aerospace Sector Deal, and the Aerospace Growth Partnership (AGP), have received substantial joint investments from the government and industry, totalling billions of pounds.

The industry’s innovation efforts align with emerging market and technology trends, such as the transition to zero-carbon aircraft, new aircraft segments like drones and electric vertical take-off and landing (eVTOL) aircraft, and the digitalisation of manufacturing for improved design, development, and supply chain integration. The nascent space tourism sector is also on the horizon, with the UK government offering grants to facilitate commercial spaceflight capability development.

Opportunities for future growth

A number of challenges/opportunities are driving policy and industrial strategies to ensure future aerospace sector growth:

- The market shift to single-aisle aircraft: Stakeholders emphasise the need for UK suppliers to adapt to the market trend favouring narrow-bodied, single-aisle aircraft. Notably, single-aisle orders in the first 10 months of 2022 reached the highest year-to-date figure since 2014, surpassing pre-COVID levels for wide-body aircraft orders.

- Competition from emerging markets: A 2016 government study reveals a 1.4% growth in UK procurement spend from 2013 to 2014, compared to a 5.2% increase globally. This indicates a rising challenge from lower-cost and developing economies, with examples such as Chinese, Japanese, and Russian efforts in regional jet programs posing competition in the civil aerospace market.

- Domestic supply chain development: To compete globally, continuous improvements and investments in quality and productivity are essential, particularly in developing capabilities and skills for various supply chain segments beyond the UK’s known strengths in engines and aerostructures.

- Trade restrictions and geopolitical issues: Rising energy prices and the depreciation of sterling pose challenges, exerting upward pressure on manufacturers’ input costs. Geopolitical events, such as the Russia–Ukraine war, disrupt the supply chain for raw materials like titanium. There’s a concern that competitors may seek to raise the cost of production for UK businesses by exploiting potential trade restrictions or removing EU exemptions for raw materials.

The data emphasises the crucial role played by the aerospace sector in the UK economy, highlighted by its substantial contribution as a key exporter. Despite challenges, the sector remains resilient, as evidenced by the UK’s position with the largest MRO market share in Europe.

As the aerospace landscape evolves, the UK MRO sector faces the imperative to adapt to more technology-intensive aircraft. The reported ageing fleets of major airlines hint at a burgeoning demand for new aircraft maintenance contracts, creating opportunities for growth in the future. The anticipated rise in composites, electrical power, health monitoring, diagnostics, and enhanced cabin interiors necessitates proactive measures.

To remain competitive in the future, the aerospace industry should prioritise maintaining a technological advantage, particularly in critical areas such as engines, wings, and advanced systems. To achieve sustained success in this dynamic industry, stakeholders suggest reinforcing training for new skills and providing increased support for late-stage product development. Furthermore, the sector should receive ongoing government support to leverage emerging technology trends and meet net-zero targets.

This article draws from Section 3 of the 2023 Innovation Report. Values reported are US$ unless identified otherwise to aid in international comparisons.

For data, references, and more analysis on the UK’s competitive advantage, including sectoral analysis of productivity and whether the UK is capturing value from the net zero transition, see the full 2023 Innovation Report produced by Cambridge Industrial Innovation Policy.

For further information please contact:

David Leal-Ayala

+44(0)1223 764908drl38@cam.ac.uk19th February 2026

Unpacking the France–UK productivity gap: a sectoral analysis

13th February 2026

The UK Manufacturing Dashboard: a tool for evidence-based industrial policy

News | 6th February 2026

UK Manufacturing Dashboard: latest performance and global benchmarks

Get in touch to find out more about working with us