Reports and articles

Singapore’s biomedical cluster: Lessons from two decades of innovation and manufacturing policy

Published on February 19th 2021

Since 2000, Singapore has managed to shift its positioning from a pharmaceutical manufacturing outpost to a location for biomedical activities across the whole innovation and manufacturing value chain. This has been supported by a coordinated, proactive and patient policy that prioritised access to funding, skilled people and infrastructure provision, underpinned by a supportive regulatory environment.

In 2000, the Singaporean government launched a strategy to develop a biomedical industry within Singapore, and in late 2003 it launched Biopolis, a purpose-built campus, which has become an example of global best practice in the formation of an innovation cluster. With a clear focus on biomedical sciences, the early stages required the development and attraction of scientific talent and proactive pursuit of FDI, while the more recent phases have seen the attractive effects of Singapore’s biomedical cluster materialise, with many companies locating manufacturing, research and management activities in the country.

Since 2000, the biomedical manufacturing industry has seen fast employment growth (7.77%) in comparison with the overall manufacturing sector (0.68%) and the Singapore economy as a whole (3.14%). This reflects the significant growth in this sector – in 2000 there were no biological drug manufacturing sites in Singapore, while by 2019 there were an estimated eighteen biopharmaceutical manufacturing plants in Singapore.

TABLE 1 – SUMMARY OF KEY INDICATORS OF SINGAPORE’S BIOMEDICAL INDUSTRY, 2019, (UNLESS OTHERWISE SPECIFIED)

Source: own elaboration based on Singapore’s EDB Department of Statistics. Department of Statistics Singapore (2020). Singstat.

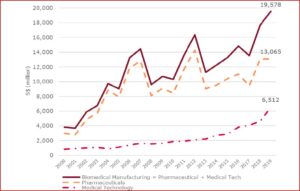

The efforts to create a biomedical manufacturing sector in Singapore are widely regarded as an economic success. As of 2019, the biomedical manufacturing sector represents 20% of total manufacturing value added (S$19.57bn, or £11.14bn), equivalent to 4% of Singapore’s GDP. From 2000 to 2019, biomedical manufacturing was the fastest-growing manufacturing sector, with a compound annual growth rate (CAGR) of 9% (compared to a 5% average growth rate for the whole of Singapore’s manufacturing sector). Within this sub-sector, the medical technology manufacturing segment experienced a 12% CAGR in added value during the same period.

FIGURE 1 – SINGAPORE: VALUE ADDED IN BIOMEDICAL MANUFACTURING, 2000–2019

Source: own elaboration based on Singapore’s EDB Department of Statistics. Department of Statistics Singapore (2020). Singstat.

This case study examines the supporting policies used to develop Singapore’s biomedical industry against the success factors normally associated with innovation clusters, deriving policy implications from these. To do this, it focuses on the physical infrastructure that formed the centre of the cluster developed by the Singaporean government in the TUAS Biomedical Park and Biopolis precinct. It also provides a history of Biopolis over the first two decades, since its inception in 2000, within the context of the wider biomedical manufacturing sector.

The specific policy measures that supported the strategy included government-sponsored global headhunting of the world’s top scientists, publicly funded research institutes and a biomedical science park, scholarship programmes for human resource formation in leading global and local universities, government venture capital for private-sector industrial projects and holistic integration of research activities, as well as more traditional tax incentives and IP frameworks.

Despite already being a manufacturing hub for pharmaceuticals, the attraction of activities across the biomedical manufacturing chain, including R&D, supported increased investments in basic science. Today, in R&D employment, Singapore employs five times more biomedical researchers per capita than the US – in 2018 Singapore boasted 128 biomedical researchers per 100,000 residents, compared to the US’s 24 biomedical researchers per 100,000 residents.

Through this whole-system approach, Singapore was able to meet and exceed its value added targets for the biomedical manufacturing industry, which were set every five years up to 2015. Similarly, biomedical manufacturing job targets were reached at each juncture. However, global targets to increase R&D to a proportion of GDP were not met, and the ratio of public to private spending on R&D in the biomedical sector still lags behind the R&D average.

For further information please contact:

Ella Whellams

+44 (0) 1223 748262erd30@cam.ac.ukDownload the report

The contributors to this briefing note are: Liz Killen, Michele Palladino, and Franco Gonzalez.

This policy brief is part of a series of studies produced for the Gatsby Charitable Foundation.

Related resources

News | 6th February 2026

UK Manufacturing Dashboard: latest performance and global benchmarks

3rd February 2026

The Swiss paradox: a services reputation built on an industrial and innovation powerhouse

News | 21st January 2026

CIIP delivers bespoke training for delegation from the Government of Nigeria

Get in touch to find out more about working with us