Reports and articles

Is the UK investing enough in innovation?

Published on August 2nd 2022

As well as achieving economic and social recovery following the Covid-19 pandemic, there are a number of fundamental challenges which are likely to dictate the shape of the UK economy for years to come. Increasing international competition; the erosion of market share in key industries; the hollowing out of supply chains; the pressure to reduce carbon emissions; the rise of living costs, and economic disparities across regions, are all issues which remain significant stumbling blocks to UK prosperity.

Innovation can lead to new products and services, as well as technological discoveries that will be critical to tackling many of these socio-economic challenges.

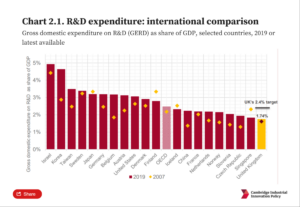

However, as it stands, the UK currently spends less on research and development (R&D) than the OECD average. At 1.74%, the UK’s gross domestic expenditure on R&D remains well below the 2019 OECD average of 2.5%.

But in what could signal a renewed focus on long-term plans to deliver innovation-led growth, innovation has been the focus of several recent policy developments. The UK Innovation Strategy: leading the future by creating it was published in July 2021, and sets out the government’s vision to make the UK a global hub for innovation by 2035. The government has also established a new Office for Science and Technology Strategy to set the vision of the National Science and Technology Council and support the UK’s science and technology capabilities in areas such as sustainable environment and Net Zero, health and life sciences, national security and defence, and the digital economy. And in July 2022, the first Chief Executive Officer and first Chairman of the new Advanced Research and Invention Agency (ARIA), modelled after the US Advanced Research Projects Agency (ARPA), were appointed.

Current state of R&D investment in the UK

For the 2022 UK Innovation Report, published annually by our team at Cambridge Industrial Innovation Policy, we asked a number of important policy questions which we hope will help to frame essential policy discussions in this area:

- Is the UK spending enough on Research & Development (R&D) when compared to other countries?

- How do the public and private sectors contribute to national expenditure on innovation?

From analysing key science and technology indicators, we identified trends which define the current landscape of the investment in R&D in the UK.

- The UK spends less on R&D than the OECD average

In 2019, the expenditure on research and development performed in the United Kingdom was equivalent to £38.5 billion. At 1.74%, the UK’s gross domestic expenditure on R&D (GERD) remains well below the 2019 OECD average of 2.5%. The UK spends less on R&D as a percentage of GDP than OECD countries, including Israel, Korea, Japan, Germany and the United States, and less than non-OECD countries such as China and Singapore.

- A significant increase in public funding for R&D has been announced but delayed

To narrow the gap between the UK’s GERD and the OECD average, a commitment to spend 2.4% of GDP on R&D by 2027 was announced in the UK’s Industrial Strategy published in 2017. To this end, the government also announced that public R&D expenditure would rise to £22 billion by 2024/25, against £13.1 billion invested in 2019. However, the £22 billion target was pushed back to 2026/27 in the 2021 Autumn Budget and Spending Review. - The business sector in the UK contributes less to R&D funding when compared to other countries

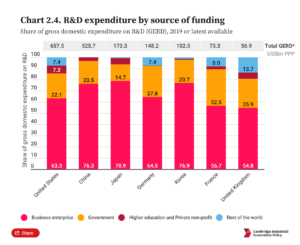

Reaching the 2.4% target (R&D investment as a percentage of GDP) will require a significant increase in private investment, in addition to public investment. However, in the UK the business sector contributes to around 55% of R&D funding. This is less than in comparator countries, such as Germany, Korea, and Japan.

Compared to other countries, universities in the UK perform significantly more of the country’s R&D and the government significantly less

In terms of R&D expenditure by sector of performance, the UK’s higher education sector stands out from comparator countries, with a 23.1% share in 2019, above countries like China, Korea, Japan, the United States, Germany and France. Conversely, the government sector in the UK performs only 6.6% of R&D, well below comparator countries.

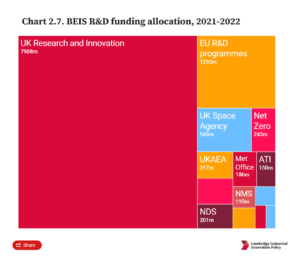

Most of the public expenditure on R&D in the UK is delivered through the Department of Business, Energy and Industrial Strategy (BEIS) that allocates funding to different agencies and programmes, including UK Research and Innovation (UKRI), public sector research establishments, and other bodies such as the National Academies. UKRI funding is primarily targeted to universities and early-stage companies, and includes the investments of the seven research councils, Research England and Innovate UK.

In the March 2020 Budget the UK government committed to the creation of the Advanced Research and Invention Agency (ARIA), an independent research body to fund high-risk, high-reward scientific research. The commitment to create ARIA involves an allocation of £800 million over the next four years. From this amount, £50 million is included in the 2021–22 Budget.

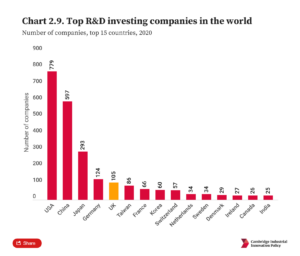

Very few firms headquartered in the UK are global leaders in R&D investment and patent applications

In 2020, among the top 2,500 R&D investing firms[1] in the world, only 105 were UK-based in 2020 (779 are based in the USA, 597 in China, 293 in Japan and 124 in Germany). Furthermore, only two companies headquartered in the UK are among the top 100 R&D investing firms in 2020.

-

Note: R&D investing companies are the 2,500 firms that invested the largest sums in R&D worldwide in 2020, as defined in the EU Industrial R&D Investment Scoreboard. These companies have headquarters in 39 countries and represent 90% of the expenditure in R&D by the business sector in 2020. Source: European Commission (2021). The 2021 EU Industrial R&D Investment Scoreboard

There were no firms headquartered in the UK among the top 100 patent applicants at the United States Patent and Trademark Office (USPTO) in 2020, 2019, and 2018. The presence of few companies with headquarters in the UK among the top patenting firms worldwide is consistent with analyses conducted by the European Commission and the OECD, covering the world’s five largest patent IP offices.[2]

Going beyond the creation of new knowledge

The UK is recognised as a world leader for its research and scientific institutions. However, tackling many of the socio-economic challenges likely to impact the UK economy in the years to come, and securing economic and social benefits from research, requires going beyond the creation of new knowledge (i.e. R&D). We need to ensure that innovation is also deployed towards commercial success and practical application.

Continuous efforts from both the public and the private sectors are needed to ensure productivity gains, the shift into higher value activities, the upgrading of existing industries, and to build the foundations for the industries of tomorrow.

[1] R&D investing companies are the 2,500 firms that invested the largest sums in R&D worldwide in 2020, as defined in the EU Industrial R&D Investment Scoreboard. Those companies have headquarters in 39 countries and represent 90% of the expenditure in R&D by the business sector in 2020.

[2] Amoroso et al. (2021). World Corporate Top R&D investors: Paving the way for climate neutrality. A joint JRC and OECD report.

This analysis draws from Section 2 of the 2022 UK Innovation Report. Values reported are US$ unless identified otherwise, to aid in international comparisons.

For data, references, and more analysis on the UK’s competitive advantage, including sectoral analysis of productivity, and whether the UK is capturing value from the net zero transition, see the full 2022 UK Innovation Report, produced by the Policy Links team at Cambridge Industrial Innovation Policy.

For further information please contact:

Ella Whellams

+44 (0) 1223 748262erd30@cam.ac.ukDr Michele Palladino is a Senior Policy Analyst within the Policy Links team of IfM Engage. This blog was informed by work conducted by Dr Carlos Lopez-Gomez, Dr David Leal-Ayala, Dr Jennifer Castenada-Navarrete, and Dr Liz Killen.

You can contact Michele and the Policy Links team at Cambridge Industrial Innovation Policy at ifm-policy-links@eng.cam.ac.uk

Related resources

News | 6th February 2026

UK Manufacturing Dashboard: latest performance and global benchmarks

3rd February 2026

The Swiss paradox: a services reputation built on an industrial and innovation powerhouse

News | 21st January 2026

CIIP delivers bespoke training for delegation from the Government of Nigeria

Get in touch to find out more about working with us